Understanding Your

Home Closing Process

Congratulations on finding your new home!

Your agent sent your contract to MBH Settlement Group. You’re off to a great start! But what’s next?

What You Can Expect?

A lot will happen between now and your closing date.

Understanding the process and what MBH Settlement Group is doing to protect you in the purchase of your new home will help ensure a smooth transaction! See a quick summary of the process.

Important Information You Need To Know

MBH makes it easy to ensure you always know what’s next and understand your role in ensuring a smooth closing.

Scroll down this page, you’ll see a step-by-step listing of your role in the process including detailed instruction.

Need more information on the terms used?

You’ll find great info in the glossary!

If you have any questions, your MBH Settlement team is happy to answer!

YOU HAVE A RATIFIED CONTRACT, WHAT’S NEXT?

Once your contract is ratified, your real estate agent will send the contract to your MBH team.

Your first step starts right away!

STEP 1: Send Earnest Money Deposit to MBH ASAP

An earnest money deposit (EMD) is money that you put down with a contract. It is a good faith deposit that shows the seller you are serious about closing the transaction.

Most often your EMD money is due within 3 days of the contract! Your contract may note otherwise, check to be certain.

IMPORTANT: Your Earnest Money Deposit

An earnest money deposit (EMD) is money that you put down with a contract. It is a good faith deposit that shows the seller you are serious about closing the transaction.

Most often your EMD money is due within 3 days of the contract! Your contract may note otherwise, check to be certain.

If your contract stipulates the MBH is to hold the EMD, you have options to send to MBH:

-

- electronic deposit*

- wire

- check (drop off at office or overnight)

Because it’s so convenient, most buyers now send their EMD (Earnest Money Deposit) electronically!

Because it’s so convenient, most buyers now send their EMD (Earnest Money Deposit) electronically!

You’ll find instructions in the Electronic EMD Instructions section below.

NOTE: If you are not able to send the EMD electronically, your check must be received by MBH by the date detailed in your contract.

Ready to send your electronic EMD? The next section provides instructions.

*At this time BankShot does not accept NFCU Cashiers Checks. If this is your bank you will need to choose to wire or drop off/overnight a check to MBH.

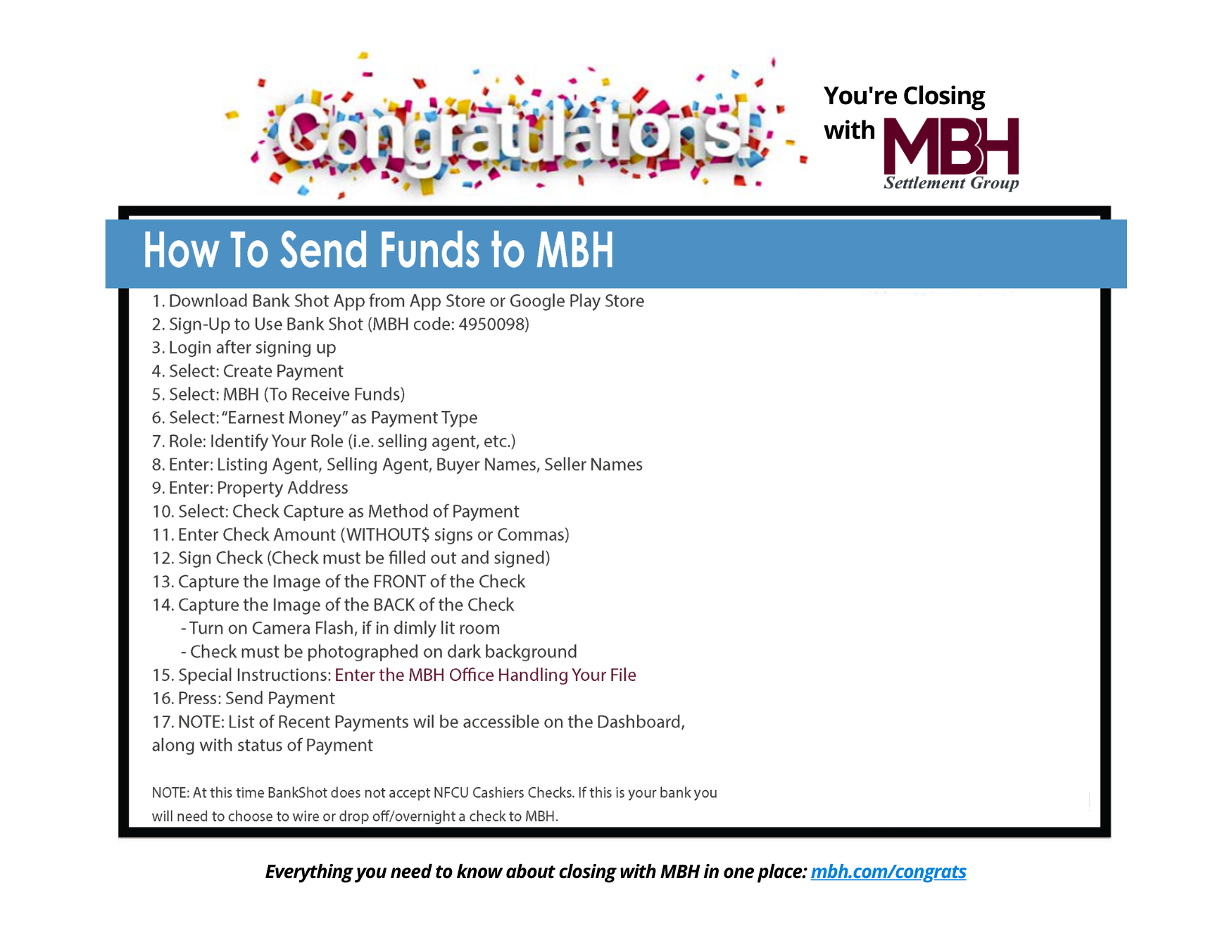

Electronic EMD Instructions

1. Download the BankShot App at the App Store or Google Play Store

2. Follow the Instructions to Send your EMD to MBH

NOTE: At this time BankShot does not accept NFCU Cashiers Checks. If this is your bank you will need to choose to wire or drop off/overnight a check to MBH.

Instructions download instructions (pdf)

Would you like to see how it works? Watch the video!

STEP 2: Log In To Your Secure Portal

After MBH Settlement Group opens your contract, you will receive an email from our secure closing document portal.

How To Log In To Your Secure Document Portal

1. Using the link in the email from MBH regarding your Secure Document Portal: Create Your Account.

2. Review the files in the Documents tab and complete the Tasks as outlined in the portal.

3. Track your closing progress online OR in the Qualia app

You can log in to the portal here.

OR

Download the Qualia App at the App Store or Google Play Store

Read The Wire Fraud Notice

Wire Fraud: Safeguard your information

To our Valued Clients,

In an effort to advise you of the rise in real estate transaction-related email hacking and fraud we are providing you with this notice.

At MBH, we will NEVER request that you use any wiring instructions other than those received in the initial and official correspondence from one of our branch offices. In an effort to further secure any funds received via wire from our offices during the course of this transaction, we will also NOT accept any alteration of any pre or post-closing email delivery of wiring instructions that differ from those provided in original form in the presence of an MBH Settlement Agent.

Should you EVER receive an email correspondence appearing to be from an MBH representative asking you to initiate a wire to an account (either matching the account noted or not matching the account noted in this correspondence), please contact that office and representative using a number from a verified source (not one provided in the body of an email you receive) and verbally confirm the validity of the request. We understand that this may sometimes be inconvenient, however, it is for your protection.

While we at MBH have taken all measures currently available to us to secure our systems, we can’t confirm or be responsible for the security of any other system that parties participating in the transaction use to communicate. Below you will find a summary of our wire policy noted above that will also appear on email correspondence that you receive from an MBH representative:

WARNING-FRAUDULENT WIRE INSTRUCTIONS

Email hacking and fraud are on the rise to fraudulently misdirect funds for real estate transactions.

Please call this office immediately, using the reliable contact information found from an independent source, to verbally verify any wire or funding instructions received. We are not responsible for any wires sent by you to an incorrect bank account.

WE DO NOT ACCEPT OR REQUEST CHANGES TO WIRING INSTRUCTIONS VIA EMAIL OR FAX.

Thank you for your business and your partnership in our efforts to safeguard your information.

If you receive suspicious communications please call your MBH representative.

Didn't Get Your Invitation Email?

Check Your Spam or Promotional folders!

Occasionally important emails are confused for Spam.

- Check Your Spam or Promotional Folder

- Still Cannot Find It? Give your MBH representative a call.

You’ll want to receive every email from MBH during this time! Take a few steps to ensure they don’t end up in “junk” files with these steps:

- Mark emails “Not Junk”

- Add the Email address to “Safe List”

- Check to see if any filter Is affecting the destination of incoming emails

- Make sure you haven’t marked MBH’s email domain (@mbh.com)email as “Spam”

- Make sure that MBH (the Sender) is not blocked

It’s still a good idea to check your junk folder daily.

STEP 3: Gather Important Information

Before you start packing, you’ll want to be sure to have a safe place for everything you need for your closing.

Info You'll Be Asked for Through The Secure Document Portal

Before you start packing, you’ll want to be sure to have a safe place for everything you need for your closing.

What Information Will You Be Asked for Through The Secure Document Portal?

- Social Security Number

- Drivers’ License or Legal Form of Identification

- Date of Birth

- HOA Information

- Confirm Lender Information

- Marital Status

- Citizenship

- How Will You Take Vesting

- Property Survey Preference

- Current Address / Forwarding Address

- Notification Of Closing Using a Power of Attorney (NOTE: Let your MBH representative know this right away!)

Don't Pack That!

In addition to the information you’ll need to input into the secure document portal, you may need to bring the following to your closing:

- All settlement documents and title policies from any properties you’ve owned (Including the property you are currently selling)

- Legal Photo Identification NOTE: Your lender may require 2 forms of identification

- Check Book

- Copy of checks written for your earnest money deposit

- Canceled checks for your mortgage or rental payments (last 12 months)

- Bank statements for all accounts; savings, investments, retirement (last 12 months)

- Separation agreements or divorce decrees

- Pay statements for the last three months

- Completed tax returns for the last two years (with W2s)

- Buyer Key Contact List

Purchasing as a Trust, LLC or Corporation?

Make sure to have your documentation available to be reviewed by your MBH team!

STEP 4: Check Your Portal To Maintain Communication

Regularly check for email (or App) notifications that the portal has been updated.

- Qualia Portal Login

- Download the Qualia App at the App Store or Google Play Store

STEP 5: Complete the Mortgage Loan Process

Be sure to follow up regularly with your lender to ensure there is no missing information.

Follow Up On Loan Application With Lender

Be sure to send all info requested by your lender ASAP.

NOTE: Delays in your lender receiving all necessary information can impact your closing date!

Lender Runs Credit Report

Your lender is responsible for checking your credit report.

Have questions? Your lender will be happy to answer them.

Loan Underwriting

NOTE: Missing info can hold up your closing date!

Buyer Approved

Be sure you’ve checked the secure portal to see if anything is needed from MBH!

STEP 6: Protect Your Investment

Your home is likely to be the biggest investment you will make.

Title Insurance is how you protect it.

MBH is a licensed agent for some of the nation’s largest and most trusted title insurance underwriters. Delivering the best protection against unknown risks, MBH has you covered!

Your MBH team is available to discuss the best options for you.

Title Insurance

PROTECTION

Title insurance is your best protection against defects (a potential risk) to a current owner’s full right or claim to sell a property. It protects against defects, which could remain hidden, despite the most thorough search of the public land records.

Lender’s Title Insurance, which covers your mortgage lender, is typically paid for by the homebuyer. It is required by the lender and protects the lender’s interest.

Owner’s Title Insurance is purchased by the home buyer. It is the best way to protect your property rights, as well as your inheritors, beneficiaries, and trustees.

DEFENSE

In the event of a claim or lawsuit challenging ownership, Title Insurance covers the policy owner for:

1. Legal Defense of your ownership interest

2. Claim Settlement if it proves valid

Owner’s Title Insurance can be your primary defense.

Your MBH team is available to discuss the best options for you!

Property Survey

What is a Survey?

A survey is a drawing showing the boundary lines, fence locations, possible encroachments onto or from neighboring properties, and easements on the property you are intending to purchase. The survey can make you aware of major issues concerning the property in time to have them remedied by the seller prior to closing.

Why do You Need a Survey?

It is generally thought to be in your best interest to have a survey done, even if it’s not required. If you have a survey, the title insurance policy will contain an exception for anything that shows up when the survey is done.

STEP 7: Get Ready For Closing

One of the most important things you can do is to gather all of your documents and secure your closing funds.

Check out the details below to ensure you’re prepared and don’t delay your closing!

Closing Funds

Your Lender will send your Closing Disclosure (CD) to you 3 days before closing. Look at this right away!

This document Includes:

- Your loan terms

- Your projected monthly payments

- How much you will pay in fees and other costs to get your mortgage (closing costs).

Your closing costs cannot be paid with a personal check.

AHEAD of your closing date, you will need either a cashier’s check or wire transfer.

It takes time to wire funds. Be sure to contact your bank immediately to understand their process and timing.

- Cashier’s Check: This is not a regular check. Your bank may require time to process this contact your bank several days in advance to understand their process.

- Wire Transfer: It takes time to wire funds. Be sure to contact your bank several days in advance to understand their process.

Gather Your Documents

- A valid, legal photo ID (your lender may require 2 forms of ID)

- Social security number

- Separated or Divorced? Bring these legal documents with you.

- Closing Funds (for the amount specified in the most recent Closing Disclosure form you received from your loan officer or lender)

- Wire Transfer Receipt (you will have needed to wire funds ahead of time; you can get your wiring instructions from MBH)

- Cashier’s Check (no personal checks)

- Checkbook (there can be variances in the amount noted on the Closing Disclosure or incidental charges)

Power Of Attorney Closings

IF you have pre-approval for a POA Closing talk with your MBH representative about your next steps.

You MUST have approval for a POA Closing well in advance of your closing date!

You will need the ORIGINAL POA at the time of closing!

The original POA will be returned to you after closing.

At Your Closing

For all of us, this is a GREAT DAY!

Expect to Read & Sign several pages of documents, including your mortgage documents and all of the paperwork you’ve received and reviewed.

Don't Forget Your Documents!

- A valid, legal photo ID (your lender may require 2 forms of identification)

- Social security number

- Separated or Divorced? Bring these legal documents with you.

- Purchasing as a Trust, LLC or Corporation? Have your documentation available for review.

- Closing Funds (for the amount specified in the most recent Closing Disclosure form you received from your loan officer or lender)

- Wire Transfer Receipt (you will have needed to wire funds ahead of time; you can get your wiring instructions from MBH)

- Cashier’s Check (no personal checks)

- Checkbook (there can be variances in the amount noted on the Closing Disclosure or incidental charges)

- Original POA (for pre-approved POA Closings only)

Celebrating The Moment

At MBH we love celebrating closings!

Whether it’s your first home, vacation dream, rental property, right-sizing, or the business you’ve always wanted, it’s time to CELEBRATE!

Don’t forget to bring a big smile – we’ll be ready with the camera!

After Closing

MBH is honored to have been with you on The Road Home!

What To Expect After Closing

MBH is honored to have been with you on The Road Home!

After closing, MBH will upload copies of all the documents you have signed to the secure portal after closing. You will also receive (in the mail) the original deed for your property and your title policy.

Be on the lookout for this and be sure to keep it in a safe place!

Congratulations!

The Closing Process

The Lender's Process

The lender’s process happens simultaneously and in conjunction with the title and settlement process.

Click on the BLUE ARROWS on the side of the image above to add the lender’s process

Loan Application

Sending Requested Info

Make sure you send all info requested by your lender ASAP.

NOTE: Delays in your lender receiving all necessary information can impact your closing date!

Credit Report

Your lender is responsible for checking your credit report.

Have questions? Your lender will be happy to answer them.

Title Underwriting

Still Missing Info?

Check to be sure your lender has everything they need in order to process your loan.

NOTE: Missing info can hold up your closing date!

Buyer Approved

Your approved loan is a big step in getting the keys to your new home!

Be sure you’ve checked the MBH secure portal to see if anything is still needed in order to make your closing date.

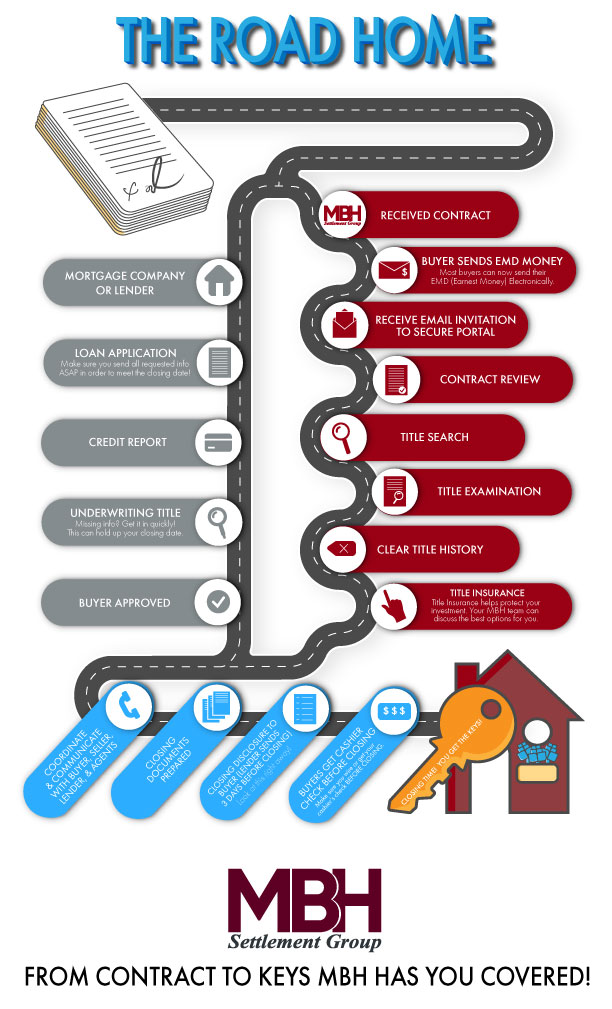

MBH RECEIVES CONTRACT

MBH RECEIVES CONTRACT

Once your offer has been accepted, your real estate agent can begin the process by sending your contract to MBH!

BUYER SENDS EMD MONEY

BUYER SENDS EMD MONEY

Most buyers can now send their EMD (Earnest Money Deposit) electronically! Contact your MBH team for

instructions.

NOTE: EMD money is due within 3 days of contract!

BUYER RECEIVES EMAIL INVITATION TO SECURE PORTAL

Once you receive your login & password, follow the process in MBH’s Secure Online Document Portal!

Log In from the MBH Buyers And Sellers Resource Hub

CONTRACT REVIEW

MBH Settlement Group will review your contract to ensure

everything is in order.

TITLE SEARCH

MBH’s abstractors will research 40 – 50 years of historical records to review the “chain of title” in order to ensure you

are free to buy the home.

TITLE EXAMINATION

MBH does a final examination and thorough review of the title search to ensure that the property being purchased is

suitable for sale.

CLEAR TITLE HISTORY

MBH is making sure that any underwriting requirements are satisfied.

TITLE INSURANCE

Your home is one of your biggest investments.

Title Insurance Is How You Protect It!

MBH is a licensed agent for some of the nation’s largest and most trusted title insurance underwriters. Your MBH team is available to discuss the best option for you.

COMMUNICATION & COORDINATION

Coordinate final details & communicate with buyers, sellers, lenders, & agents regarding missing info, closing times, etc.

PREPARE CLOSING DOCUMENTS

Getting close!

CLOSING DISCLOSURE TO BUYER

This comes from your Lender!

NOTE: Lender sends 3 days before closing.

Look at this right away!

BUYERS GET CASHIER CHECK BEFORE CLOSING

BUYERS GET CASHIER CHECK BEFORE CLOSING

Get your cashier’s check or wire BEFORE CLOSING.

NOTE: Cashier’s Check: This is not a regular check. Your bank may require time to process this contact your bank several days in advance to understand their process.

Wire Transfer: It takes time to wire funds. Be sure to contact your bank immediately to understand their process and timing.

DISTRICT OF COLUMBIA

1775 Eye Street NW Suite 560

Washington, DC 20006

202-518-9300

BETHESDA

8120 Woodmont Ave

Suite 810

Bethesda, MD 20814

301-941-4990

ALEXANDRIA (OLD TOWN)

228 S. Washington St

Suite 100

Alexandria, VA 22314

703-739-0100

ARLINGTON

2101 Wilson Blvd

Suite 1250

Arlington, VA 22201

703-237-1100

Email

Directions

BURKE

703-913-8080

STERLING (HQ)

21631 Ridgetop Circle

Suite 285

Sterling, VA 20166

703-277-6800

FAIR OAKS

12150 Monument Dr

Suite 850

Fairfax, VA 22033

703-279-1500

FREDERICKSBURG

1956 William St

Fredericksburg, VA 22401

540-373-1300

FRONT ROYAL

824 John Marshall Hwy

Front Royal, VA 22630

540-878-4210

GAINESVILLE

7470 Limestone Dr

Gainesville, VA 20155

703-468-2020

KINGSTOWNE

5911 Kingstowne Village Pkwy

Suite 140

Kingstowne, VA 22315

703-417-5000

LAKE RIDGE

4565 Daisy Reid Ave

Suite 200

Woodbridge, VA 22192

703-492-7900

LOUDOUN

43490 Yukon Drive

Suite 109

Ashburn VA, 20147

703-840-2000

MANASSAS

703-393-0333

STAFFORD

9 Center St

Suite 105

Stafford, VA 22556

540-658-0992

Tysons

1945 Old Gallows Rd

Suite 615

Vienna, VA 22182

703-242-2860

WARRENTON

484 Blackwell Rd

Suite 108

Warrenton, VA 20186

540-349-7990

Winchester

817 Cedar Creek Grade

Suite 203

Winchester, VA 22601

540-546-0615