It’s Tax Time! What’s Deductible?

By Christina de Uribe, Esq.

April 15th will be here before we know it! There is no better time to familiarize yourself and your clients with potentially tax-deductible closing cost items.

While real estate agents and settlement attorneys aren’t tax specialists, and your clients should always seek advice from a CPA, the information in this article will assist in guiding your clients in the right direction.

DEDUCTABLE EXPENSES

To deduct expenses of owning a home, you must file Form 1040 U.S Individual Income Tax Return, and itemize your deduction on Schedule A.

1. Mortgage Interest is another typical itemized deduction. Mortgage interest is usually paid in arrears; and interest is prepaid on the Closing Disclosure (CD) through the end of the

month in which you close. This amount should be included in the mortgage interest statement, Form 1098, provided by the lender.

2. Qualified Mortgage and Private Mortgage Insurance premiums the borrower pays may also be an itemized deduction on Schedule A. The amount paid during the year may be shown on Box 5 of the Form 1098, Mortgage Interest Statement.

3. Points are typically deductible (may also be called loan origination fees, or discount points). If you meet a points test created by the IRS, you can either deduct the full amount of the

points as interest in the year paid or deduct them over the life of the loan.

4. Real Estate Taxes assessed to the homeowner are deductible. The homeowner must have paid them at settlement or to a taxing authority (either directly or through an escrow account) during the year. Please note that the deductibility of many of these expenses are limited in some circumstances.

EXPENSES THAT INCREASE THE HOME’S TAX BASIS

What if you are not exempt from Capital Gains Tax?

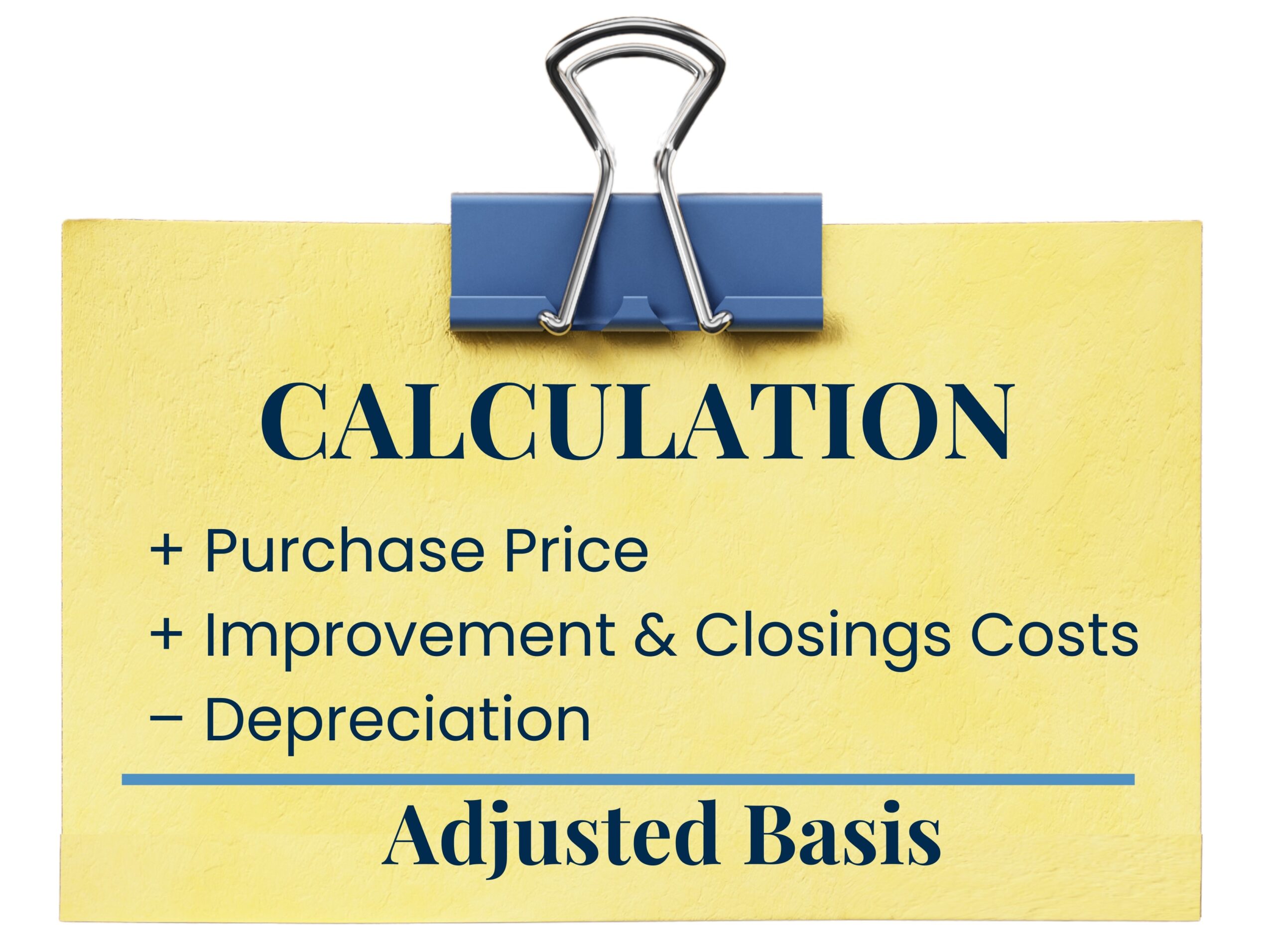

The amount of gain calculated for tax purposes is the amount realized less the adjusted tax basis in the property. Generally, the adjusted tax basis is calculated using the equation below.

Certain closing costs that may be part of the original basis include:

- Title Search Fees

- Legal Fees

- Recording Fees

- Cost of Survey

- Transfer or Stamp Taxes

- Owner’s Title Insurance

- Seller Owed Items the Buyer Pays i.e. back taxes

![]()

- Any sales commission (for example, a real estate agent’s sales commission)

- Any Fees for a Service That Helped Sell Your Home

- Any Advertising Fees Paid by The Seller

- Any Legal Fees Paid

NONDEDUCTIBLE EXPENSES

There are at least a handful of settlement statement line items that are neither deductible, nor can they be added to the property’s basis.

Examples of these items include:

- Credit loan charges including credit report fees, appraisal fees and preparation of mortgage note or deed of trust fees

Hazard insurance premiums paid in advance or into the lender’s escrow account - Homeowner’s association dues and condominium dues

- Rent for pre-occupancy of home

- Charges for utilities

While you’re not an accountant…

You can provide value, without giving them a thorough analysis of their tax implications!

Reach Out to your buyers who closed in 2023 with their ALTA & our Quick Tax Checklist!

Remind your sellers they MUST report the sale & their ALTA includes potential tax savings!

Call Your Local MBH Office with Any Questions!

This material contains general information intended for licensed real estate agents and is not intended nor should it be relied upon as legal advice. Independent counsel should be consulted directly for specific advice on any particular circumstances. For information, you and/or your client(s) should consult a tax attorney, certified public accountant, or the Internal Revenue Service.

DISTRICT OF COLUMBIA

1775 Eye Street NW Suite 560

Washington, DC 20006

202-518-9300

BETHESDA

8120 Woodmont Ave

Suite 810

Bethesda, MD 20814

301-941-4990

ALEXANDRIA (OLD TOWN)

228 S. Washington St

Suite 100

Alexandria, VA 22314

703-739-0100

ARLINGTON

2101 Wilson Blvd

Suite 1250

Arlington, VA 22201

703-237-1100

Email

Directions

BURKE

703-913-8080

STERLING (HQ)

21631 Ridgetop Circle

Suite 285

Sterling, VA 20166

703-277-6800

FAIR OAKS

12150 Monument Dr

Suite 850

Fairfax, VA 22033

703-279-1500

FREDERICKSBURG

1956 William St

Fredericksburg, VA 22401

540-373-1300

FRONT ROYAL

824 John Marshall Hwy

Front Royal, VA 22630

540-878-4210

GAINESVILLE

7470 Limestone Dr

Gainesville, VA 20155

703-468-2020

KINGSTOWNE

5911 Kingstowne Village Pkwy

Suite 140

Kingstowne, VA 22315

703-417-5000

LAKE RIDGE

4565 Daisy Reid Ave

Suite 200

Woodbridge, VA 22192

703-492-7900

LOUDOUN

43490 Yukon Drive

Suite 109

Ashburn VA, 20147

703-840-2000

MANASSAS

703-393-0333

STAFFORD

9 Center St

Suite 105

Stafford, VA 22556

540-658-0992

Tysons

1945 Old Gallows Rd

Suite 615

Vienna, VA 22182

703-242-2860

WARRENTON

484 Blackwell Rd

Suite 108

Warrenton, VA 20186

540-349-7990

Winchester

817 Cedar Creek Grade

Suite 203

Winchester, VA 22601

540-546-0615